RAFA Scores - Deep Dive

A methodical approach to Technical Analysis

In the ever-evolving landscape of financial markets, investors and traders are constantly seeking new tools and methodologies to gain an edge. Enter RAFA Scores, a sophisticated quantitative approach that's revolutionizing the way we analyze price momentum in equities and cryptocurrencies. This innovative scoring system, inspired by the chart-reading techniques of the world's top traders, offers a nuanced and multifaceted view of market trends that could prove invaluable for investors at all levels.

Understanding RAFA Scores

At its core, the RAFA scoring system is designed to distill complex technical analysis into easily digestible numerical values. These scores, ranging from 0 to 10, provide a comprehensive assessment of an asset's momentum and associated risks across multiple time frames. By leveraging advanced machine learning algorithms and quantitative models, RAFA Scores aim to capture the essence of what seasoned traders see when they scrutinize charts, offering this insight in a standardized, objective format.

The Three Time Frames

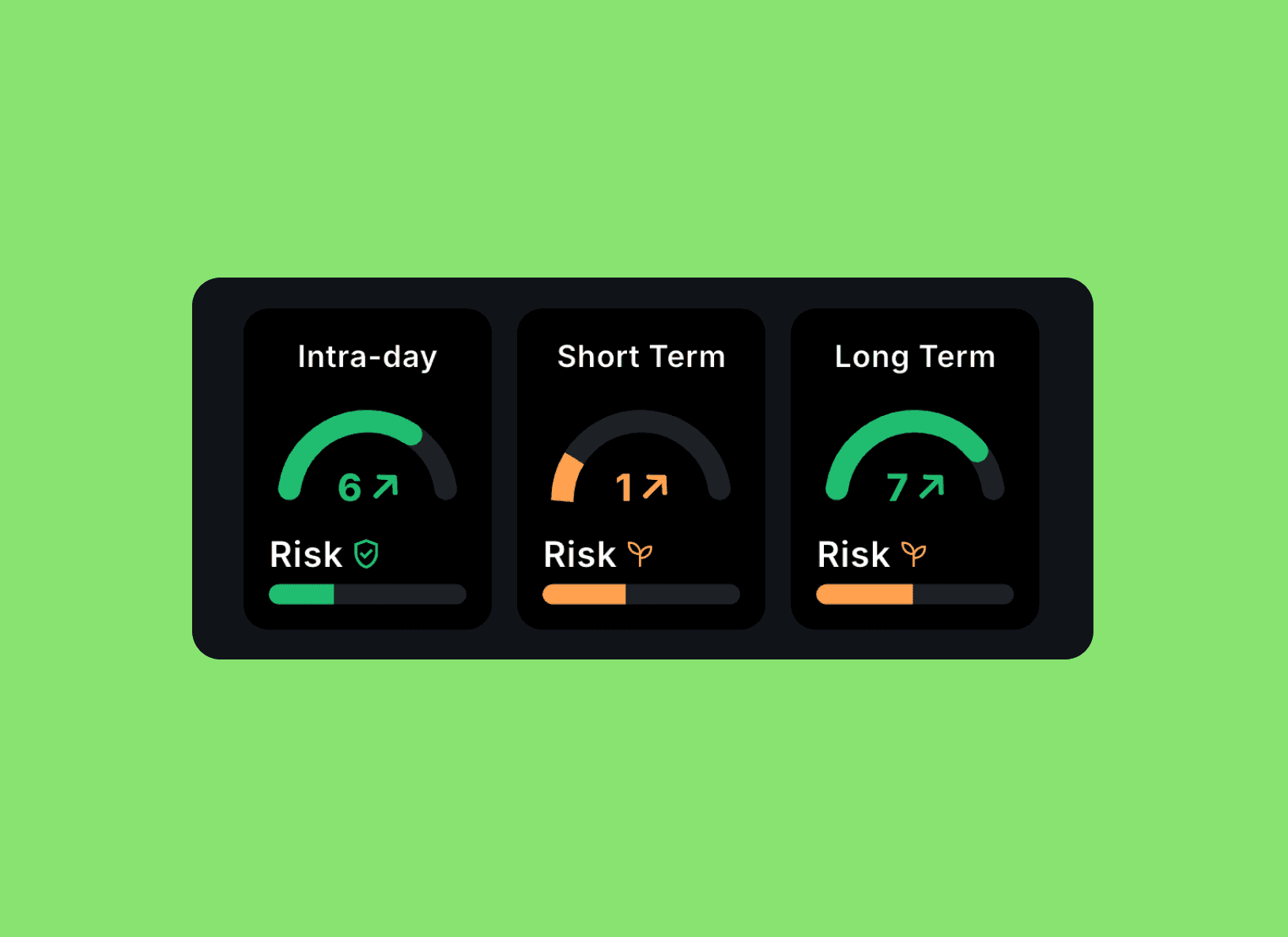

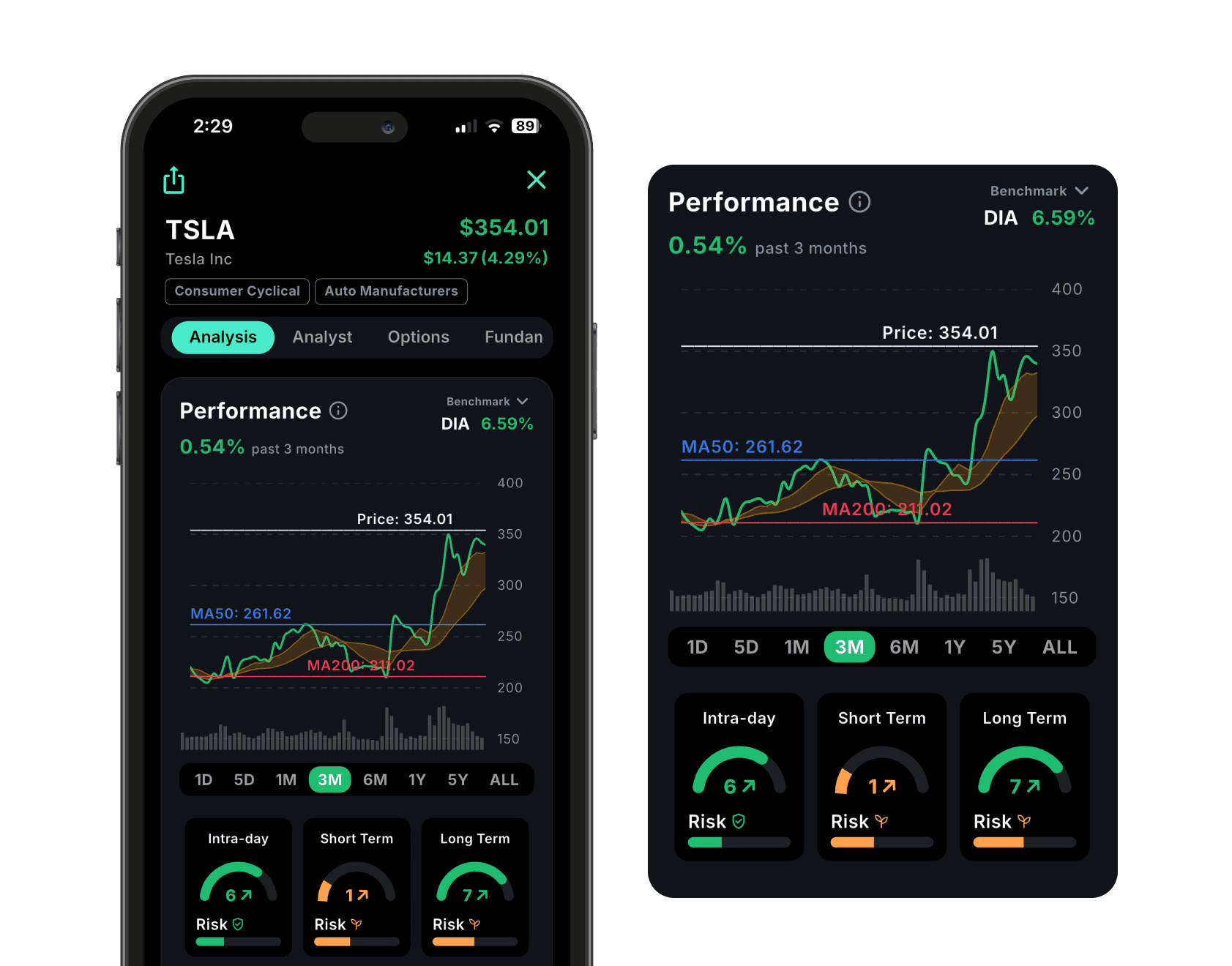

One of the most powerful aspects of RAFA Scores is their multi-temporal approach. Recognizing that different investors have varying time horizons, the system provides scores for three distinct time frames:

Intraday (Hourly): Updated every hour, these scores cater to day traders and those looking to capitalize on short-term price movements.

Short-term (Daily): Updated daily, typically three hours after market close for equities and one hour after the UTC daily close for cryptocurrencies, these scores are ideal for swing traders and short-term investors.

Long-term (Weekly): Also updated alongside the daily scores, these provide a broader perspective for investors with a longer time horizon.

This multi-timeframe approach aligns well with the philosophy of legendary investor Peter Lynch, who emphasized the importance of understanding both the short-term catalysts and long-term potential of investments. By providing scores across these three timeframes, RAFA enables investors to align their analysis with their specific trading or investing strategy.

Momentum vs. Risk: A Crucial Distinction

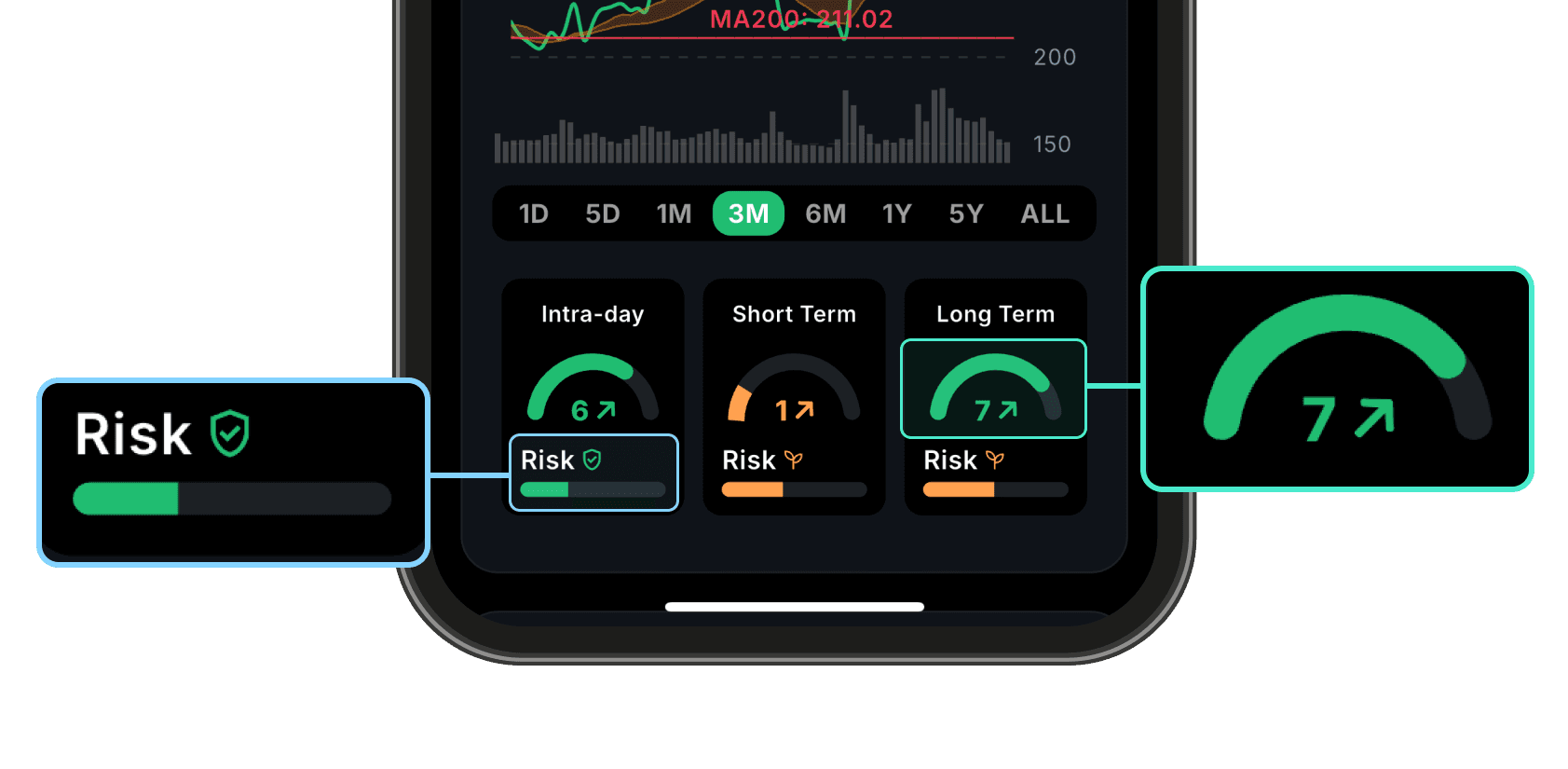

A key innovation of the RAFA system is the separation of Momentum and Risk scores. Each timeframe receives two distinct 10-point scores: one for Momentum and one for Risk. This bifurcation addresses a critical nuance in market analysis that is often overlooked: strong momentum doesn't always equate to a low-risk opportunity.

Consider a stock that has been on a tear, rising dramatically over the past few weeks. Traditional momentum indicators might flag this as a strong buy signal. However, the RAFA system might show a high Momentum score coupled with a high Risk score, indicating that while the asset has strong upward momentum, it may be overbought and at risk of a pullback.

This nuanced approach resonates with the teachings of renowned investors like Warren Buffett, who famously said, "Be fearful when others are greedy, and greedy when others are fearful." The Risk score in the RAFA system can help investors identify when market sentiment might be overextended, potentially signaling times to be cautious even in the face of strong momentum.

The Quantitative Edge

The power of RAFA Scores lies in their quantitative foundation. The system employs advanced machine learning models that analyze a wide array of technical indicators, including but not limited to:

Moving Average Convergence Divergence (MACD)

Price and volume features

Relative Strength Index (RSI)

Trendlines

MA Breakouts/breakdowns

Moving Averages (Short and Longer term)

Price Percentage Changes

S/R levels

Moreover, the system incorporates derived features based on these technical indicators, creating a rich, multidimensional view of an asset's technical position. This comprehensive approach allows RAFA Scores to capture nuances that might be missed by focusing on any single indicator.

Trend Count: Gauging Trend Maturity

An additional feature of the RAFA system is the Trend Count, which measures how long an asset has been in its current trend. This metric provides crucial context to the Momentum and Risk scores. As a general principle in technical analysis, younger trends are more likely to continue, while mature trends may be at higher risk of reversal.

The Trend Count aligns with the concept of market cycles, a cornerstone of technical analysis. By providing this information alongside the RAFA Scores, the system gives investors a more complete picture of where an asset might be in its cycle, helping to inform decisions about entry and exit points.

Practical Applications of RAFA Scores

The versatility of RAFA Scores makes them applicable to a wide range of investment strategies:

Day Trading: Intraday scores can help identify short-term opportunities and risks.

Swing Trading: Short-term scores, combined with intraday scores for entry timing, can guide multi-day positions.

Long-term Investing: Weekly scores can help identify assets with sustained momentum for longer-term holdings.

Risk Management: The separate Risk scores can be used to set stop-loss levels or to decide when to take profits.

Portfolio Construction: By screening for assets with specific score profiles, investors can build diversified portfolios aligned with their risk tolerance and investment goals.

Importantly, the system's multi-timeframe nature allows for cross-verification. For instance, a day trader might feel more confident in a trade when the intraday, short-term, and long-term scores all align, suggesting a unified trend across multiple time horizons.

"Q: I am looking for a day trade, How are the technicals for TSLA? "

Screening and Integration

One of the most powerful applications of RAFA Scores is in stock screening. Using RAFA AI Agents like Strategy-Wiz, investors can easily filter for stocks based on specific score thresholds. For example, one might screen for stocks with a Short-term Momentum score above 6 and a Risk score below 4, quickly identifying potential opportunities that align with a particular strategy.

Moreover, when integrated with other forms of analysis, RAFA Scores can provide additional confirmation or raise red flags. For instance, if fundamental analysis suggests a stock is undervalued, but its RAFA Scores show weak momentum and high risk across all timeframes, it might signal that the market hasn't yet recognized the stock's value, or that there are hidden risks not captured by fundamental metrics.

"Q: Find me stocks with a short term trend score above 6 and a market cap above 100B "

Limitations and Considerations

While RAFA Scores offer a powerful tool for market analysis, it's crucial to understand their limitations. Like all technical analysis tools, they are based on historical price action and may not capture fundamental changes in a company or the broader market environment. Additionally, in periods of extreme market volatility or during significant economic events, the predictive power of any technical tool, including RAFA Scores, may be diminished.

It's also worth noting that while the scores provide a standardized view of market trends, they should not be used in isolation. The most robust investment strategies typically combine technical analysis with fundamental research, macroeconomic considerations, and a clear understanding of one's own risk tolerance and investment goals.

Conclusion

RAFA Scores represent a significant leap forward in the field of technical analysis, offering a quantitative, multi-dimensional view of market trends that was previously the domain of only the most experienced chart readers. By distilling complex technical data into easily interpretable scores across multiple timeframes, this system provides investors with a powerful tool for identifying opportunities, managing risk, and making more informed investment decisions.

As with any investment tool, the key to success with RAFA Scores lies in understanding how to interpret and apply them within the context of a broader investment strategy. When used judiciously, in conjunction with other forms of analysis and a clear investment philosophy, RAFA Scores have the potential to significantly enhance an investor's ability to navigate the complex and ever-changing world of financial markets. By providing a nuanced, quantitative view of market trends and risks, RAFA Scores offer investors a valuable tool to stay informed, manage emotions, and make data-driven decisions in their quest for investment success.